At its core, ServiceNow is a cutting-edge, cloud-based platform designed to optimize and automate business processes. It is a comprehensive solution that integrates various functions, enabling organizations to seamlessly manage operations, resources, and services. With its user-friendly interface and scalable architecture, ServiceNow caters to businesses of all sizes, from startups to multinational corporations.

As a leading provider of digital workflows and enterprise cloud solutions, ServiceNow recognizes the importance of effectively measuring and improving Profit and Loss (P&L) metrics. By analyzing and optimizing these financial indicators, ServiceNow aims to drive business growth, enhance profitability, and deliver value to its stakeholders.

Learn more: 6 key Features of ServiceNow Change Management – Apty

Overview of ServiceNow’s Capabilities in Various Business Domains

ServiceNow boasts a wide array of capabilities that span across diverse business domains, ensuring comprehensive support for various operational aspects:

- IT Service Management (ITSM): ServiceNow empowers IT departments to manage incidents, requests, changes, and problems efficiently. Its automation tools help resolve issues promptly, reducing downtime and enhancing IT service quality.

- Human Resources: Simplifying HR processes, ServiceNow facilitates employee onboarding, benefits administration, and performance management. This module enhances workforce productivity and engagement.

- Customer Service Management (CSM): ServiceNow’s CSM tools enable businesses to deliver exceptional customer experiences. It offers omnichannel support, case management, and self-service portals for improved customer satisfaction.

- Security Operations: With the increasing cybersecurity threats, ServiceNow’s security operations module aids in identifying and responding to security incidents swiftly, ensuring data protection and compliance.

- Field Service Management: For organizations with field operations, ServiceNow optimizes field service tasks by offering real-time visibility, resource allocation, and task tracking.

How ServiceNow Contributes to Streamlining Processes and Improving Efficiency

ServiceNow’s impact on process optimization and efficiency enhancement is undeniable:

- End-to-End Automation: ServiceNow’s workflow automation minimizes manual intervention, reducing human errors and accelerating task completion. It leads to increased operational efficiency.

- Centralized Data Management: The platform serves as a centralized repository for business data, fostering collaboration and informed decision-making across departments.

- Real-time Analytics: ServiceNow’s reporting and analytics tools provide actionable insights into process performance, enabling continuous improvement strategies.

- Enhanced Communication: With its collaborative features, ServiceNow promotes transparent team communication, leading to quicker issue resolution and project completion.

- Scalability and Flexibility: As businesses evolve, ServiceNow scales to accommodate changing needs, ensuring long-term efficiency gains

Learn more: 14 Best Practices for ServiceNow Implementation – Apty

Key Profit and Loss Metrics for Measurement

In the realm of business, success is often measured by profitability. For companies to thrive and grow, they must deeply understand their financial performance. This requires tracking revenue and analyzing various profit and loss metrics that provide valuable insights into the company’s health and viability.

Imagine standing in front of an intricately painted mural where every brushstroke tells a story. Each stroke represents a different aspect of the company’s financials, revealing its strengths and weaknesses with remarkable clarity. Similarly, one can unravel the narrative behind a business’s monetary affairs when examining key profit and loss metrics.

These metrics serve as powerful tools that enable managers and investors alike to assess the effectiveness of strategies employed, identify areas for improvement, and make informed decisions moving forward. By delving deeper into the world of these essential measurements, we can uncover the secrets they hold and unlock new avenues for growth and prosperity.

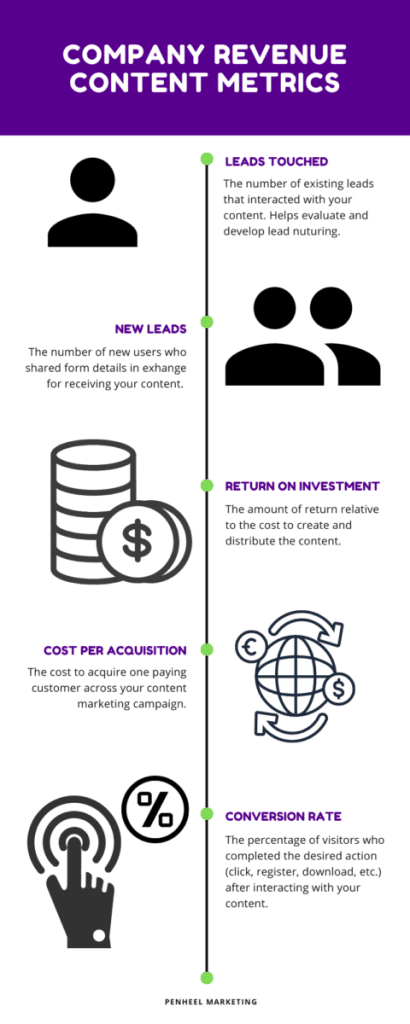

Revenue Metrics

Source: Penheel

Revenue metrics provide valuable insights into the revenue generated by a company through its products and services, as well as the revenue generated from different regions or markets.

The importance of revenue metrics:

- Revenue by product or service allows companies to assess individual offerings’ performance and identify improvement areas.

- Revenue by region helps companies understand their market presence in different geographic locations and make informed decisions regarding expansion or consolidation strategies.

- Total revenue is an overarching measure of a company’s overall financial success, providing a comprehensive view of its performance across all products, services, and markets.

By analyzing these revenue metrics, businesses can understand their revenue sources and take appropriate actions to maximize profitability.

Learn more: Revenue Metrics for the Revenue Marketer

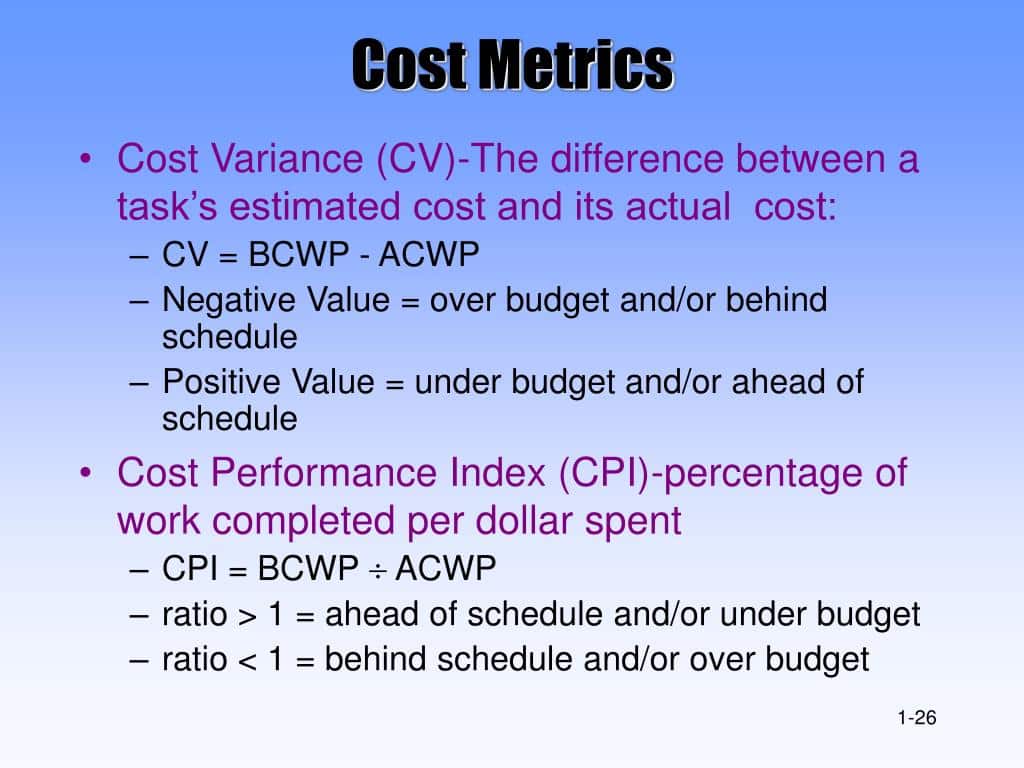

Cost Metrics

Source: Slideshare

To effectively evaluate a company’s financial performance, it is essential to analyze revenue and costs.

A critical metric in this regard is the cost of goods sold (COGS), which represents the direct expenses associated with producing or acquiring products sold by a business. Additionally, operating expenses play a crucial role in determining profitability as they include all other costs incurred in running a business except for COGS.

By understanding these cost metrics, businesses can assess their gross profit margin, indicating how efficiently they generate profits from their core operations. Companies can gain valuable insights into their financial health and make informed decisions regarding pricing strategies, resource allocation, and budgeting.

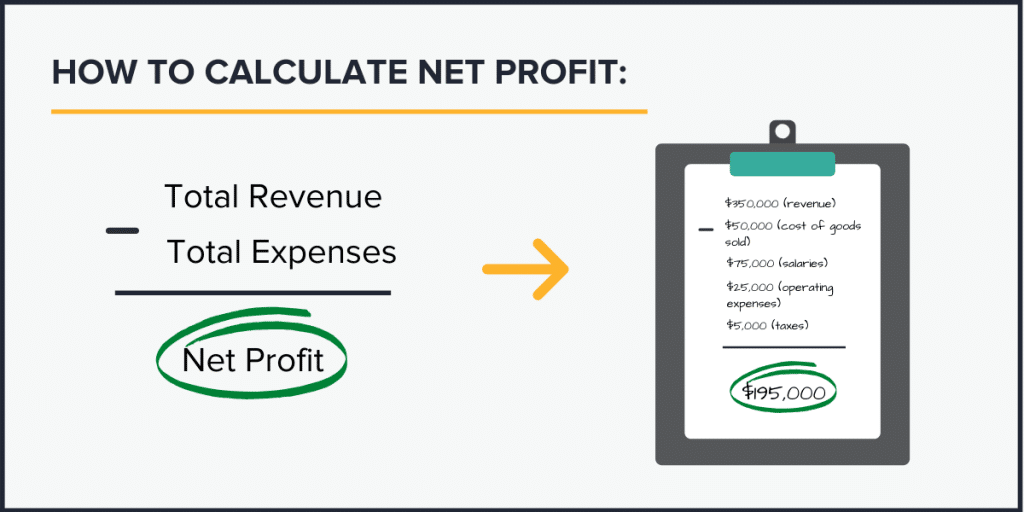

Net Profit Metrics

Source: Fastloans.ph

Measuring key profit and loss metrics is crucial for businesses to assess their financial performance.

One important metric often used is net profit or net income. Net profit represents the earnings after deducting all expenses, including taxes and interest, from the total revenue generated by a business.

Another significant metric is earnings before interest and taxes (EBIT), which measures a company’s profitability before considering the impact of interest expenses and tax payments.

Before interest, taxes, depreciation, and amortization (EBITDA), earnings consider additional non-cash expenses such as depreciation and amortization. These metrics provide valuable insights into a company’s overall financial health and can help stakeholders make informed decisions based on its ability to generate profits.

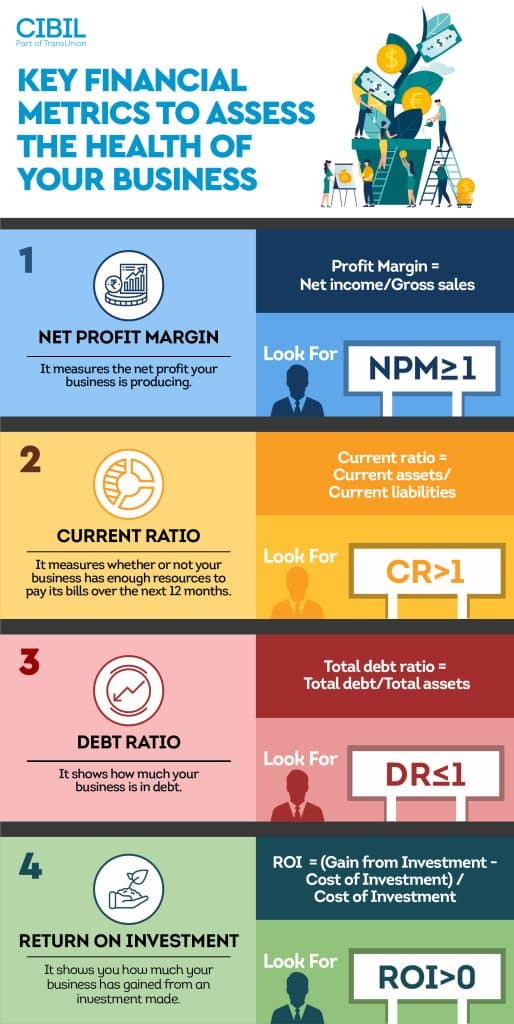

Financial Efficiency Metrics

Source: msmesaksham

Financial efficiency metrics are essential for businesses to assess their performance and identify areas of improvement. These metrics, such as the gross profit margin, operating profit margin, and return on investment (ROI), provide crucial insights into a company’s profitability and effectiveness in utilizing its resources.

Satirically speaking, it is amusing how these measurements evoke various emotions among stakeholders. The gross profit margin indicates the percentage of revenue that remains after deducting the cost of goods sold, indicating a company’s pricing strategy or operational inefficiencies.

Similarly, the operating profit margin reflects the proportion of sales revenue left over after accounting for variable and fixed costs, highlighting a firm’s ability to control expenses and generate profits from core operations.

Lastly, ROI measures the return from investments relative to their cost, illustrating whether capital expenditures have been fruitful. Businesses can make informed decisions regarding resource allocation and overall strategic direction by analyzing these financial efficiency metrics comprehensively and objectively assessing their implications. As organizations strive to maximize profitability while minimizing costs and risks, understanding and monitoring these key indicators play a vital role in achieving long-term success.

The key profit and loss metrics discussed above provide a comprehensive framework for measuring financial performance. Net profit metrics are essential to overall profitability, considering revenue and costs. Businesses can assess their ability to generate earnings from their operations by analyzing net profit margin or return on investment.

Significance of ServiceNow Profit and Loss Metrics for Business Growth

Financial Health Assessment

Assessing the financial health of a business is essential for its long-term sustainability and growth. A thorough evaluation of profit and loss metrics, such as revenue, expenses, and net income, provides valuable insights into the overall financial performance of an organization. These metrics serve as key indicators in determining the profitability and efficiency of operations.

An in-depth analysis of profit and loss metrics allows businesses to identify areas of strength and weakness within their financial structure. Companies can pinpoint which products or services generate the most significant returns by closely examining revenue streams. This knowledge empowers decision-makers to allocate resources effectively and make informed strategic choices that maximize profitability.

Moreover, a comprehensive understanding of expenses is crucial for effective cost management. Analyzing various expense categories enables businesses to identify potential areas where costs can be reduced or optimized without compromising operational efficiency.

Furthermore, net income serves as a critical metric for evaluating business performance. It reflects whether a company’s revenues exceed its expenses, ultimately indicating its profitability. Positive net income demonstrates that the business is generating profits, while negative net income highlights potential issues the company must address promptly.

Decision-Making Support

One of the key advantages of utilizing ServiceNow profit and loss metrics is the valuable decision-making support they provide to businesses. Companies can gain actionable business insights by closely monitoring financial performance indicators such as revenue, expenses, and net income. These metrics offer a comprehensive view of the organization’s financial health, enabling managers and executives to make informed decisions that drive growth and profitability.

With accurate profit and loss metrics, decision-makers can evaluate the performance of different business units or product lines. It empowers them to identify areas of strength and weakness within the company’s operations, enabling targeted strategies for improvement. Furthermore, these metrics help assess the potential impact of various decisions on overall profitability, allowing for more intelligent resource allocation and cost management.

Performance Evaluation

Performance evaluation is crucial to analyzing ServiceNow profit and loss metrics for business growth. By closely examining financial data, companies can assess the effectiveness of their operations and make informed decisions to drive future success. Evaluating performance metrics such as revenue growth, gross margin, and return on investment provides valuable insights into the financial health of an organization.

Through performance evaluation, businesses can identify areas of improvement and establish strategies to optimize profitability. It enables them to track their progress and set measurable goals to drive continuous growth. Practical performance evaluation fosters a culture of accountability and encourages teams to strive for excellence in their respective roles. Aligning individual performance with organizational objectives helps create a motivated workforce that contributes significantly to overall business success.

Investor Confidence

ServiceNow profit and loss metrics are vital to instill confidence in potential investors and maintain it among existing shareholders. By analyzing these metrics, investors gain insights into the organization’s financial health, which enhances their trust and willingness to invest in the company.

When investors observe positive profit and loss metrics trends, such as consistent revenue growth, improved profitability ratios, and effective cost management, they become more inclined to view the company as a promising investment opportunity. Financial solid performance attracts capital and reassures stakeholders that the business is well-managed and capable of generating sustainable returns.

The transparency offered by ServiceNow profit and loss metrics enables investors to make informed decisions based on reliable data. It empowers them to evaluate a company’s financial stability, growth potential, and competitive position within the industry. Ultimately, investor confidence fosters long-term partnerships between businesses and their shareholders, creating a stable foundation for further expansion and success.

Benchmarking and Industry Comparison

One of the key advantages of using ServiceNow profit and loss metrics is the ability to engage in benchmarking and industry comparison. By analyzing and comparing financial data with industry peers, businesses gain valuable insights into their performance, strengths, and areas for improvement. This process allows companies to set realistic goals and make informed decisions that align with industry trends.

Through benchmarking, businesses can identify best practices, innovative strategies, and successful approaches implemented by their competitors or leaders in the field. This knowledge empowers organizations to adapt processes, optimize performance, and stay ahead of the curve. Moreover, by studying successful industry counterparts’ financial indicators, companies can build investor confidence by demonstrating a strong market position.

Tackling Challenges in Evaluating and Enhancing ServiceNow Profit and Loss Metrics

- Data Accuracy and Availability: Organizations face a significant challenge in ensuring accurate and available data for evaluating and enhancing ServiceNow profit and loss metrics. Maintaining data accuracy requires robust governance processes and validation checks at every stage of data handling. Investing in reliable data management tools and secure storage infrastructure is essential for minimizing errors and enabling confident decision-making based on accurate metrics.

- Defining Relevant and Meaningful Metrics: The definition of relevant and meaningful metrics is crucial for assessing the financial health of an organization within the ServiceNow framework. While economic indicators like revenue growth and profit margins are essential, non-financial metrics such as customer satisfaction and service quality must be noticed. Adopting a comprehensive approach that considers quantitative and qualitative factors provides a holistic understanding of performance and supports informed decision-making.

- Establishing Clear Measurement Criteria: Setting clear criteria is a significant challenge in evaluating ServiceNow profit and loss metrics. Comprehensive parameters and benchmarks should be defined to reflect financial performance within the ServiceNow ecosystem. Both quantitative factors like revenue growth and qualitative aspects like customer satisfaction should be incorporated to gain a well-rounded view of profitability and make informed decisions for improvement.

- Change Management and Resistance: Implementing changes in evaluating profit and loss metrics can encounter resistance. Effective change management involves communicating the proposed changes’ purpose and benefits. Engaging stakeholders early, addressing concerns, and involving them in decision-making fosters ownership and innovation. Providing training, support, and celebrating successes helps build confidence and create a culture that embraces change.

- Balancing Short-term and Long-term Metrics: Balancing short-term and long-term measurements is crucial when evaluating ServiceNow profit and loss metrics. Focusing solely on short-term metrics like revenue growth and cost reduction can hinder long-term sustainability. Conversely, exclusive emphasis on long-term metrics might need more attention to immediate profitability concerns. Striking a balance involves considering direct financial impacts while aligning with strategic goals and long-term sustainability objectives. This approach builds resilient strategies catering to immediate needs and future aspirations.

Learn more: ServiceNow implementation cost

Enhancing ServiceNow’s Contribution to P&L Metrics through DAPs

Streamlining Employee Onboarding and Training

Digital Adoption Platforms (DAPs) are crucial in facilitating the onboarding process for new employees onto the ServiceNow platform. Here’s how they contribute to this aspect:

- Interactive Guidance: DAPs provide real-time, step-by-step guidance to new employees navigating the ServiceNow platform. This interactive guidance ensures they can quickly find and understand the necessary tools and features.

- Reduced Learning Curve: DAPs offer contextual assistance, enabling new hires to learn the platform’s functionalities hands-only. It minimizes the learning curve and accelerates the time it takes them to become proficient users.

- Personalized Onboarding: DAPs can customize the onboarding experience based on each employee’s role and responsibilities. It ensures employees receive training relevant to their job functions, enhancing their productivity.

Driving Operational Efficiency

DAPs contribute significantly to operational efficiency within the ServiceNow environment:

- Process Guidance: Complex processes within ServiceNow, such as incident management or change requests, can be guided by DAPs. Users receive real-time prompts and walkthroughs, reducing the likelihood of errors and ensuring adherence to best practices.

- Faster Issue Resolution: DAPs can provide troubleshooting assistance, helping users resolve issues more efficiently. It minimizes bottlenecks and delays in processes, leading to improved operational flow.

- Cost Savings: The streamlined processes facilitated by DAPs result in cost savings. Fewer errors and reduced rework mean that resources are used more effectively, ultimately positively impacting the bottom line.

Reducing Support Costs and Downtime

DAPs can significantly impact the costs associated with user support and system downtime:

- Self-Service Empowerment: DAPs empower users to find solutions independently, reducing the need for constant IT support. Users can access guidance and information directly within the platform, minimizing disruptions caused by minor issues.

- Reduced Support Ticket Volume: The number of support tickets and requests can decrease with improved user competence through DAPs. This frees IT teams to focus on more critical tasks, reducing support costs.

- Enhanced Uptime: Users who can effectively navigate the platform are less likely to encounter errors that could lead to downtime. As a result, the organization experiences improved system availability and reliability.

Leveraging Apty for Enhanced ServiceNow ROI and P&L Impact

Apty, a leading Digital Adoption Platform (DAP), emerges as a pivotal force in shaping Profit and Loss (P&L) metrics and amplifying Return on Investment (ROI) within ServiceNow deployments or any software ecosystem. Its multifaceted contributions are transformative:

- Enhanced User Efficiency and Productivity: Apty propels users to master intricate software landscapes effortlessly. In the context of ServiceNow, renowned for IT service management and workflow automation, Apty’s guided navigation expedites processes, slashing learning curves and expediting task execution. These time savings radiate as heightened productivity, nurturing a favorable impact on the bottom line.

- Substantial Reduction in Training Expenditure: Navigating complex platforms like ServiceNow necessitates extensive training investments. Apty’s embedded in-app guidance, tooltips, and systematic tutorials curtail external training prerequisites significantly. This curbing of training costs directly elevates P&L positivity.

- Diminished Support Overheads: Real-time, on-screen assistance, a hallmark of Apty, empowers users to preempt common missteps and issues. This proactive support curtails support ticket surges and diminishes help desk interjections, leading to a marked reduction in operational support expenses.

- Accelerated Onboarding and Adoption: Swift acclimatization of new hires to organizational systems is imperative. Apty expedites this integration, shepherding newcomers through processes, thereby accelerating productivity. This acceleration translates into rapid ROI attainment within the ServiceNow investment sphere.

- Enforced Process Compliance and Augmented Accuracy: Apty ensures adherence to standardized methodologies within platforms like ServiceNow, mitigating errors and fortifying compliance. This vigilance safeguards against expensive mishaps and amplifies operational fluidity.

- Data-Informed Insights: Apty’s analytics and reporting suite, characteristic of advanced DAPs, empowers administrators with profound user behavior insights. Patterns and areas of struggle unearthed by this data herald process enhancement, catalyzing performance augmentation and enriching user experiences.

- Unveiling Untapped Features: Apty illuminates concealed or underutilized features within potent platforms like ServiceNow. This heightened feature engagement maximizes the value extracted from ServiceNow investments, optimizing organizational potential.

- Navigating Change Seamlessly: Apty’s pivotal role extends to managing updates, transitions, and novel features inherent in platforms like ServiceNow. This expert guidance quells resistance and accelerates adaptation, averting workflow disruptions and ensuring sustained productivity.

- Quantifiable ROI Assessment: Apty’s robust metrics and reporting capabilities empower organizations to gauge its impact on diverse performance indicators. From user engagement to task completion rates, these metrics crystallize the tangible ROI wrought by Apty, definitively influencing the organization’s P&L outlook.